Allianz chief economic adviser Mohamed El-Erian, who is by far one of my favorite market pundits, was on CNBC yesterday explaining how Fed officials have basically painted themselves into a corner with their “backward looking monetary new framework” that will make it very difficult for them to take their proverbial foot off the pedal.

In other words, by continuously repeating that “inflation will be transitory” (read: temporary) and that they’re “not thinking about raising rates,” Fed officials have made it very difficult for themselves to act swiftly and effectively.

Usually, the central bank’s best tool to thwart inflation would be to signal that they are about to raise rates, but at this point, any such talk would certainly spook the markets.

Let’s ignore for now the absurdity of the Fed trying to sell the world on the idea that inflation will be transitory when the dollars they’re printing are clearly permanent.

Currently, the markets remain calm, because they’re betting that Fed officials would rather double down on their previous statements rather than change course and suddenly raise interest rates, an action that would certainly spook the markets.

Yup, that’s what’s standing in the way of a total market meltdown, erroneous circular logic.

Along came inflation

But wait… there’s more….

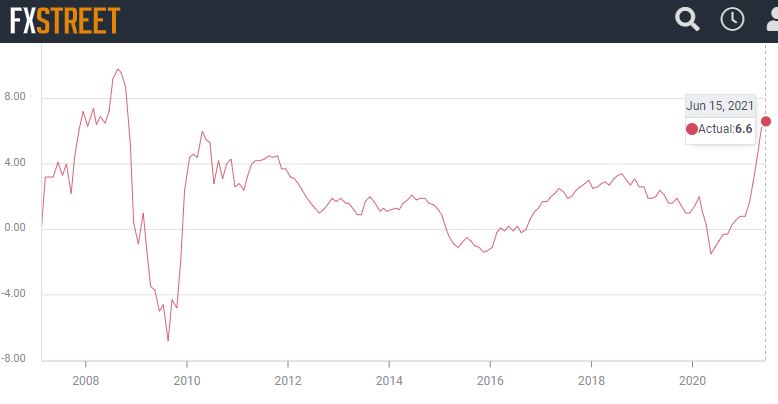

A few hours ago, the U.S. reported further evidence that inflation has reached dire levels. The producer price index (PPI), which measures the average prices of goods and services produced, rose a dismal 6.6% during the 12-month period ending in May.

This was the greatest figure in the history of this particular measure (the 12-month PPI), which the Bureau of Labor Statistics first started calculating in 2010.

Diligent readers will no doubt recall that last week we covered the consumer price index (CPI) reading, which was reported at 5%. This was the highest level since the great financial crisis.

If you’re not familiar with these acronyms though, CPI or PPI, just know that they’re both BS.

As Kyle Bass, the founder & chief investment officer of Hayman Capital, scrupulously opined, the actual inflation rate at this time is more like 12%. He stated this after the Fed increased the money supply by roughly 34% over the last 14 months.

The thing is that another worrying metric came out today. The retail sales figures show that despite all the new money and the dissipating virus, the economy isn’t even that hot.

This will have to be a topic of discussion in the upcoming Fed meeting tomorrow, where they will undoubtedly be asking themselves whether the juice is worth the squeeze.

Perhaps now we can come to understand this seemingly confusing headline. …

It’s not that Jamie Dimon wants to hold cash so that it will lose its value. Instead, given the evidence, he’s expecting that the Fed officials will have to change their tune and hike rates in order to stave off this massive amount of inflation.

Sure, it will likely harm the markets, but the damage that would likely happen to the economy if they don’t take swift action could be a lot worse.

So, having this kind of cash on hand would be great for buying the dip on such an event. It only makes sense.

What about bitcoin?

The last economist on our list is the hedge fund billionaire Paul Tudor Jones, a known bitcoin proponent who seems to be on the opposite end of Dimon’s trade.

He’ll want to see what the Fed does tomorrow of course, but according to the legend, if the central bank’s officials continue to talk down inflation and fail to take action, it will be “a green light to bet heavily on every inflation trade.”

He also managed to tease out the WallStreetBets crowd by hinting that commodities would be a killer investment should the Fed allow inflation to run rampant. So it would seem that inaction from central bank officials could very well send bitcoin and other cryptocurrencies straight to the moon.

On the other hand, what might be the reaction from digital assets given a hawkish Fed tomorrow?

If the key stakeholders show concern about inflation and talk about raising interest rates, we can assume it will not be good for stocks. However, the possible effect on crypto is less clear-cut.

My feeling is that after the close to 50% pullback we experienced last month, digital assets are not nearly as overvalued as the stock market is right now.

Bitcoin, in particular, is seen as a hedge against Fed money printing (and the inflation it could cause) in the eyes of many.

So if the Fed does crash the market, there’s a real chance that bitcoin, and possibly other cryptocurrencies, may be seen as safe havens.

I’d like to give a special shoutout to everyone who reads to the end.