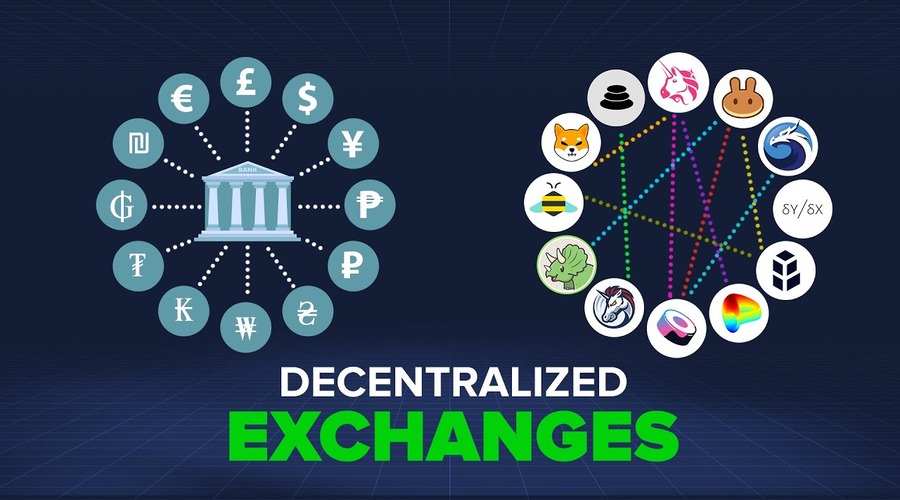

The world of finance has seen a lot of transformation over the years, and in recent times, the emergence of Decentralized Finance (DeFi) has disrupted the traditional finance industry. Decentralized exchanges (DEXs) are an integral part of the DeFi ecosystem, providing a platform for users to trade cryptocurrencies in a trustless and decentralized manner. In this article, we will explore decentralized exchanges in DeFi, their benefits, challenges, and the future of DEXs.

Introduction to Decentralized Exchanges (DEXs)

A decentralized exchange is a peer-to-peer exchange that operates on a decentralized blockchain network. Unlike centralized exchanges (CEXs), DEXs are not owned or operated by a single entity, making them more secure and trustless. Transactions on DEXs are executed using smart contracts, which means that users have full control over their funds.

Benefits of Decentralized Exchanges

Trustless Trading

One of the significant benefits of DEXs is that they eliminate the need for intermediaries such as banks, brokers, and other third parties. In a decentralized exchange, the user has full control over their funds, making the trading process more transparent and trustless.

Security

Another major advantage of DEXs is that they are more secure than centralized exchanges. Since DEXs are built on a decentralized blockchain network, there is no central point of failure. This means that there is no single point of attack, making DEXs more resilient to hacking attempts.

No KYC/AML

Most centralized exchanges require users to complete a KYC (Know Your Customer) and AML (Anti-Money Laundering) process to verify their identity before they can trade. In contrast, DEXs do not require users to provide personal information, making them more private and anonymous.

Liquidity

In the early days of DEXs, liquidity was a significant challenge. However, with the rise of automated market makers (AMMs) and other innovative liquidity solutions, DEXs are now more liquid than ever before.

Challenges of Decentralized Exchanges

Despite the numerous benefits of DEXs, there are still some challenges that need to be addressed.

User Interface

One of the biggest challenges of DEXs is their user interface. While most centralized exchanges have user-friendly interfaces, DEXs can be more challenging to use, especially for new users.

Limited Asset Availability

Unlike centralized exchanges that list a wide range of assets, DEXs have limited asset availability. This can be a significant drawback for traders who want to trade less popular tokens.

High Transaction Fees

Transaction fees on DEXs can be high, especially during periods of high network congestion. This can be a significant issue for traders who frequently move funds between different wallets.

How Decentralized Exchanges Work

In a decentralized exchange, users connect to the blockchain network through a web3 wallet such as Metamask or Trust Wallet. Users can then search for the token they want to trade and connect to a liquidity pool. Liquidity pools are smart contracts that hold a reserve of tokens used to facilitate trades. When users want to buy a token, they deposit another token into the pool, and the smart contract automatically executes the trade.

The Future of Decentralized Exchanges

Despite the challenges faced by DEXs, their popularity continues to grow. According to data from Dune Analytics, DEXs traded over $540 billion in 2020, up from just $2 billion in 2019. With the rise of innovative solutions such as Layer 2 scaling and cross-chain bridges, DEXs are poised to play a more significant role in the future of finance.

Conclusion

Decentralized exchanges are essential to the DeFi ecosystem, providing a more secure, trustless, and transparent platform for users to trade cryptocurrencies. While there are still some challenges to be addressed, the future of DEXs looks bright, with more users and innovative solutions being developed every day.