By far, one of the most written about subjects in the financial world at the moment is the great disconnect between what’s happening in the economy and what’s happening in the stock market.

The reasons by now are clear to all. It’s not about any potential COVID-19 cure or speculation on a miraculous economic recovery from the unprecedented lockdowns.

No, the George Floyd riots have shown us that investors are no longer even looking at the current economy when making their decisions. It’s all about the Fed.

Additionally, retail investors are coming into the market in droves, which according to this piece from Exponential Investment Management is driving the stock markets even higher.

After all, eventually the unrest will pass and the economy will go back to normal, it’s only a matter of time. Or is it??

A good friend of mine who managed to make it out of Venezuela and who still has family there once told me that the greatest lesson he learned from the economic meltdown there was that “things can always get worse.”

Looking at the feedback loop playing out in American media at the moment and escalations in the clashes between law enforcement and protesters, it only seems to be getting worse, not better. We do sincerely hope that things get better very quickly, but there certainly isn’t any guarantee of that.

Therefore, the fact that stocks are once again nearing their all time highs is unbelievable. Investors should be extremely cautious at this stage, even though the VIX “fear index” is now at it’s lowest levels since the COVID-19 crisis began.

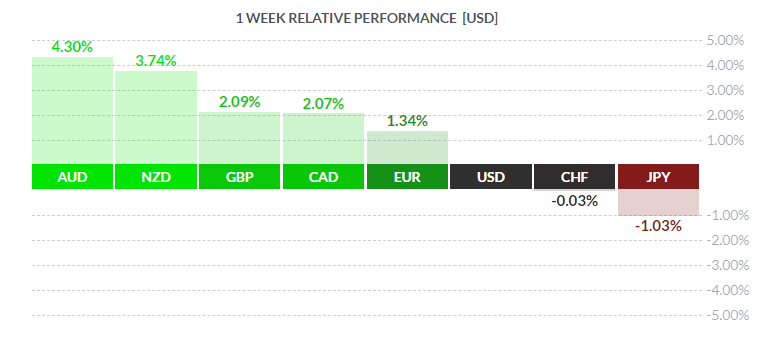

Gold is also down today, as are safe-haven currencies. The U.S. dollar, the Swiss franc, and the Japanese yen are all selling off, so technically the market is in full-on risk mode and appears to have not a care in the world. After all, many U.S. states are finally starting to open back up.

Hello Simpson My Old Friend

Crypto traders know the pattern all too well. Large leg up spiky consolidation at the top, and the quick leg back down. The infamous Bart Simpson pattern strikes again bring us back under the $10,000 level that we so proudly touted in yesterday’s BMJ Newsletter.

Even Bloomberg is yelling “ay, caramba” …

Famous analyst John Bollinger, the guy who invented the Bollinger Bands, called the move a “head fake.” At least we know who’s head. ;D

I see it a bit differently though, and all we need to do is to zoom out to see that this is all just movement within a range. While it’s true that we failed to create a new support level at $10,000 this time around, we also failed to breach any major support levels to the downside, and the upward channel that we’ve been observing since the mid-March bottom is still very much intact.

Of course, past performance is not an indication of future results, so we’ll need to see how this plays out.